non filing of income tax return notice reply

Login to your e-Filing account at incometaxindiaefilinggovin with your user name and password. Login to httpsincometaxindiaefilinggovin The Income Tax Department has created a module in its interface called Compliance to respond such notices.

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

Penalties for Late Income Tax Return Filing in India Above information will be a useful guide when you are replying to a compliance guide.

. And go to compliance Tab after login. You can respond to the notice through your income tax e-Filing Account. How to reply to non-filing of Income Tax Return Notice AY 2019-20.

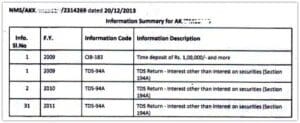

Helo Sridhar i think u your client received a notice for short deduction or non payment of tds for this you have to first verify the previously filed return by downloading conlsolidated file from NSDL web site after registraion along with default details which is an excell file where u find all the default details or u can contact to the respective income tax ward. This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered. A VNF does not provide proof that you were not required to file only that you did not file.

It is also possible that. 2010-11 relevant to ay. Interest is not calculated with respect to the extension of payment deadlines and the suspension of.

If the taxpayer fails to comply with all the terms of a notice issued under section 143 2 Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. You can respond to the notice of non-filing of returns via online channel. What is an IRS Verification of Nonfiling Letter.

You reply non filing of income tax return notice is. The income tax department has extended the time limit for filing of response to notices under section 1421Taxpayers are normally required. View Non-filers information Non-filers Information and Information.

In case the remunerator isnt able to file GST returns a reply citing reasons for the delay in filing GST return along with a request for extension may be submitted in writing. Login to your Income Tax Department website account. Once received you need to respond to it within 15 days from the date of receiving the notice.

Most of assesses are Receiving Email with subject as Compliance Income tax Return Filing. The reason for which you are receiving the notice will be mentioned under this tab. 4 If you have received notice of non-filing by mail ie compliance notice then you should do the following.

First of all you need to login to Incometaxindiaefilinggovin After that go to the Compliance tab and go to Select Information summary. However if no reply is furnished it will be presumed that you have not filed any return of income for the fy. If the return is filed then simply click the option that the return is filed.

How to Reply to Notices Online Log in to the portal and find the Compliance tab where you can see the non-filers information. Click on Compliance Menu Tab and you will be re-directed to the Compliance portal. Process How to respond Notice NoN return filing of Income Tax.

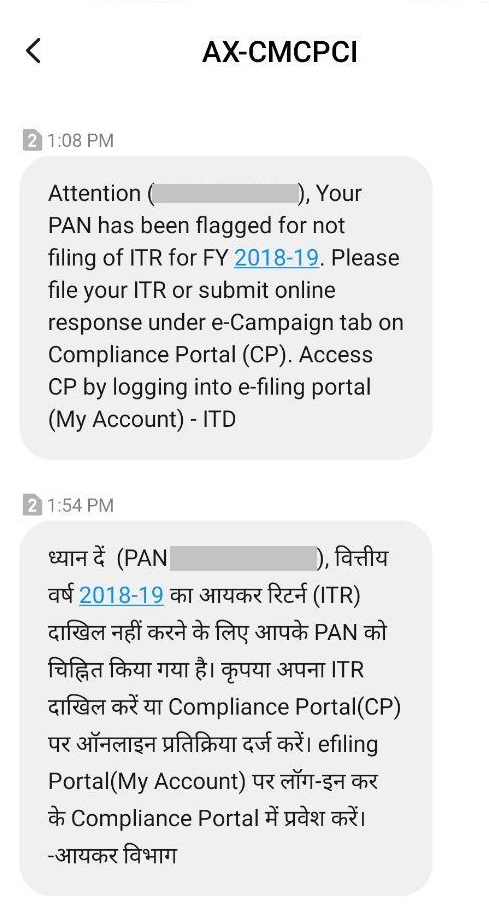

Go to the For Your Action tab under Worklist section and select whether the return is filed or not. In most of the cases the IT department sends notices by emails or by SMS. If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR.

Notice for Non-Disclosure of Income. You get a defective return notice under section 139 9 of the Income Tax Act. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department.

Login to your Income Tax Department website account. With the Above mission in the mind recently Income Tax department are sending Notice to various assesses who has not filed their Income tax Return and Seeking information as per AIR Filing by various Institution. Disclaimer- All the information given is from credible and authentic resources and.

Below are the step by step guidelines on how to respond to the notice. This tab will show the year for which return is not filed. An IRS Verification of Nonfiling Letter VNF will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested.

Login to e-filing portal Login to e-filing portal at httpincometaxindiaefilinggovin and click on Worklist. Returns Not Filed It can happen that you missed filing your return while your employer has deducted the tax. If you do not have a login id password you may have to first register your PAN.

Below are the step by step guidelines on how to respond to the notice. You can view the. Taxpayers are required to submit the response on the e-filing website following the steps below.

You could get this notice within a year of the end of the assessment year for which return has not been filed. The department is getting strict with the non filers sending notices to non-filers for even earlier assessment years as well. There are two situations.

Responding to the Notice for Non-Filing of Return. In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails. 5 Claim of Refund of Taxes.

The licensed person under GST will have to appear before the tax officer for the non-public hearing and judge on a course of action. If a person makes huge or high-value transactions not filing income tax return there are every chances of getting a notice if Income Tax Return is not filed. File your ITR as soon as possible and attach the ITR-V or reply with Return under preparation.

Following are some of the main reasons why you might receive a notice from the Income tax Department. Under the View and Submit Compliance tab you will find a Filing of Income Tax return option through which you. There is no need of personal presence in this matter.

2011-12 and further approriate action as per income tax Act 1961 will be initiated.

How To Respond To Non Filing Of Income Tax Return Notice

How Should You Respond To A Defective Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Reply Notice For Non Filing Of Income Tax Return

How To Handle Income Tax It Department Notices Eztax India

How To Respond To Non Filing Of Income Tax Return Notice

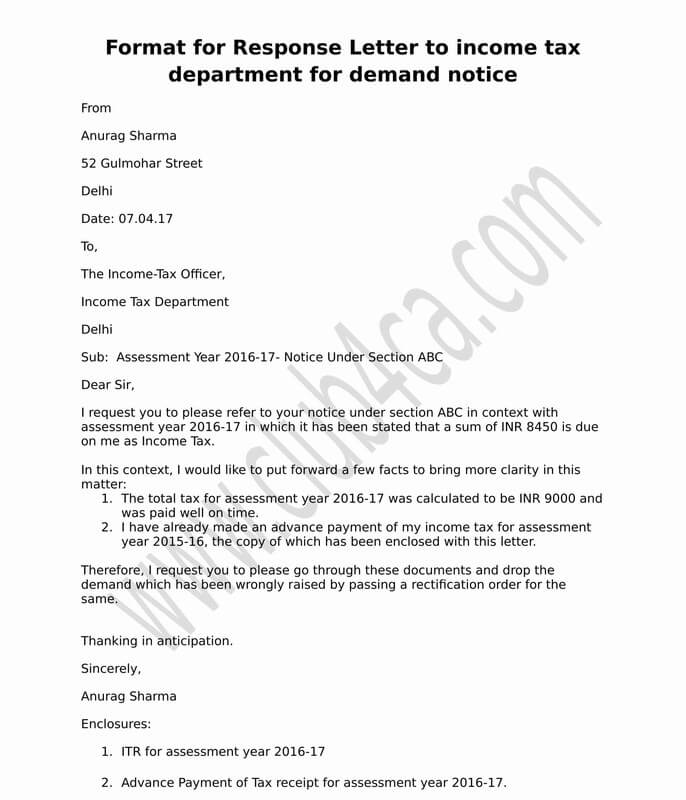

Letter Format To Income Tax Department For Demand Notice